On April 2, 2025, the United States government issued a landmark Executive Order reshaping its trade policy through sweeping tariff reforms. At the core of this change is a newly introduced universal base tariff of 10%, applicable to nearly all imports entering the U.S. from April 5, 2025. India and other Asian trade partners are now recalibrating their strategies in response to this shift, which signals a new era in international commerce.

What’s Changing in U.S. Tariff Policy?

According to the Executive Order and corroborated by Reuters :

- A flat 10% base tariff will apply to most imports, regardless of origin, starting April 5, 2025.

- India faces a 26% reciprocal tariff, effective from April 9, 2025.

- The new tariff policy comes amid increasing global trade tensions and aims to “level the playing field,” targeting perceived trade imbalances, particularly with China and Vietnam.

Impact on Indian Exports

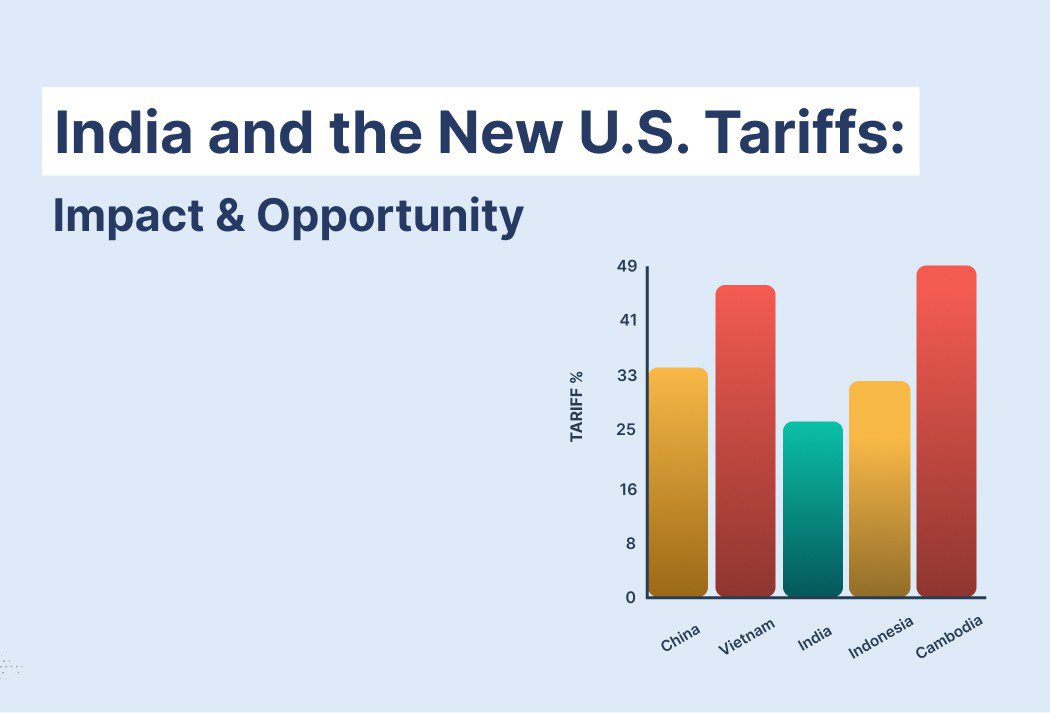

India is not exempt from the new measures, but the tariff imposed on Indian goods (26%) is among the lowest compared to its Asian peers, which face rates as high as 49% (Cambodia) and 46% (Vietnam). This positions India somewhat favorably for tariff arbitrage in sectors where production costs are competitive.

Sectoral Impact

PHDCCI's analysis breaks down the anticipated effects across key Indian export sectors:

| Sector | Export Share | Impact | Remarks |

| Precious/Semi-precious stones | 9.93 | Moderately Negative | Not Exempted |

| Electrical machinery | 7.37 | No affect | Not Exempted |

| Pharmaceuticals | 7.07 | Positive | Exempted |

| Petroleum products | 6.27 | Positive | Exempted |

| Textiles/Apparel | 3.72 | Negative | Not Exempted |

| Marine products | 2.21 | Moderately Negative | Not Exempted |

| Vehicles & parts | 1.52 | Moderately Negative | 25% Tariff under separate order |

| Iron/Steel articles | 1.13 | Moderately Negative | 25% Tariff under separate order |

| Chemical products | 0.69 | Negative | Not Exempted |

Who’s Exempt?

Some categories of goods have been excluded from the tariff hike:

- Pharmaceuticals, semiconductors, copper, energy products, and critical minerals.

- Products already subject to other Executive Orders, like automobiles, steel, and aluminum.

- Goods from USMCA countries (Canada, Mexico) and nations without normal trade relations (e.g., Russia, North Korea) are treated separately.

Timeline for Tariff Implementation

Understanding the effective dates is crucial for exporters and importers:

| Date Range | Tariff Applied |

| April 5, 2025 | 10% base tariff on new entries |

| April 6–8, 2025 | 10% on goods in transit |

| On or after April 9, 2025 | 26% on Indian imports |

Comparative Tariff Landscape in Asia

| Country | Tariff % |

| China | 34 |

| Vietnam | 46 |

| India | 26 |

| Japan | 24 |

| Indonesia | 32 |

| Cambodia | 49 |

| Singapore | 10 |

| Phillippines | 17 |

| Malaysia | 24 |

India’s relatively lower tariff rate offers a competitive edge in some markets, especially where global supply chains are seeking alternatives to China.

Opportunities and Challenges Ahead

While the short-term impact on Indian exports—particularly in textiles, chemicals, and marine products—may be negative, sectors like pharmaceuticals and petroleum stand to benefit. Moreover, India's low-cost production base and favorable tariff positioning offer long-term advantages for businesses willing to adapt.

PHDCCI emphasizes that strong governmental support and strategic repositioning can help Indian exporters navigate this turbulent phase. Diversification, compliance adaptation, and investing in exempted or less-impacted sectors will be key.

In Summary

The U.S. tariff overhaul marks a significant turning point in global trade. For India, it’s a mix of challenge and opportunity. By staying informed and agile, Indian businesses can not only withstand the shockwaves but also turn them into momentum for growth.

Get instant quote

and compare offers in real time

Get instant quote

and compare offers in real time