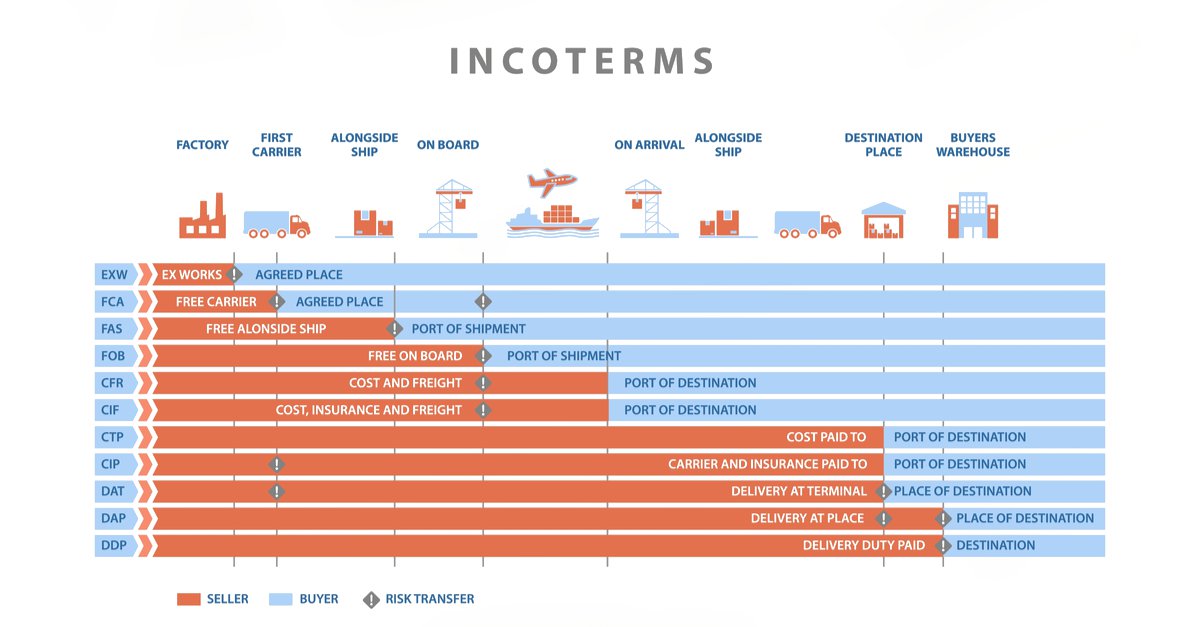

The International Chamber of Commerce publishes and updates the Incoterm rules every 10 years based on the state of global trade and updated policies among carriers. For those engaged in international trade, understanding these terms is critical to knowing how sea freight costs evolve and who bears the liability for all shipments at various legs of transportation.

Most Used Incoterms in Freight Industry

Ex Works (EXW)

EXW defines the point of collection of the goods by the buyer, and it must be agreed upon by both the buyer and seller. This Incoterm is in the greatest proximity to the beginning of the shipment lifecycle.

When this term is used, it puts the goods at the disposal of the buyer immediately, meaning the buyer takes over responsibility for the shipment or otherwise transfers their liability to another party, such as a carrier (carriage provider in the context of this publication) within the next Incoterm.

Free Carrier (FCA)

FCA is specific to the seller’s obligation to deliver goods to a given point for transport by a given carrier, whether by air, sea, road or rail. The carriage is arranged by the buyer. This term gives flexibility in that it doesn’t specify the mode of carriage, but it does require sellers to handle: Export packaging, loading charges, delivery to port or place, export duty, and taxes and customs clearance.

Carriage Paid To (CPT)

The Incoterm rules that begin to put more pressure on buyers to set the means and cost of transport start with CPT. The CPT Incoterm defines the need for the seller to deliver the goods at their expense to another destination, concluding with the transfer of goods.

The particular nature of this term implies the seller pays for the full cost of all exports needs, as well as terminal handling charges and any other costs determined by the carriage provider. However, this particular Incoterm doesn’t cover insurance. Thus, the seller becomes fully responsible for the cost of goods sold and their direct value without the assistance of the next term.

Carriage and Insurance Paid To (CIP)

CIP covers both the transport, its handling (including unloading) and insurance coverage for the materials until it arrives at the destination denoted by CIP.

It’s important to note that this is one of the ICC Incoterm rules that doesn’t pinpoint a specific location, but rather a broad area such as a city. It’s not until the destination is more closely defined that another term must be used.

Delivered at Place (DAP)

DAP places the burden of responsibility on the seller until the shipment is delivered to a specific place, such as a warehouse or a given shipping facility. However, the buyer is still responsible for all customs costs for the country of import, as is the case with all of the above Incoterms.

Delivered at Place Unloaded (DPU)

If the buyer elects to have the seller maintain responsibility until unloading, DPU is the Incoterm to use. This is best reserved for shipments where the buyer may not have the resources or experience needed to fulfill the shipping needs. For instance, high-cost freight requiring expertise in its shipping may be best-suited for DPU designation. However, it’s ultimately up to the buyer whether they will assume this added cost. Another option is to pass this cost along to the buyer.

Delivered Duty Paid (DDP)

The final of the primary Incoterms in international transit is DDP. This Incoterm is perhaps the first step where the seller has the most risk and the buyer is essentially risk-free. The seller assumes all responsibility for transport and cross-border trade, including obtaining customs clearance for imports and exports along the way.

While the above Incoterms carry weight, they are not necessarily all-encompassing. When maritime trade is concerned, four additional terms come into play.

Free Alongside Ship (FAS)

In FAS, the seller clears freight for export and places it alongside the vessel at the port of departure. It then becomes the responsibility of the carrier to load the freight with a crane. This term is most often used by short-haul drayage providers.

Free on Board (FOB)

Unlike FAS, FOB requires the seller to assume the responsibility of shipping up to and including the cost of loading the shipment on a named vessel. Upon loading to the vessel, the buyer assumes responsibility for the freight.

Cost and Freight (CFR)

This term is used only if the seller has access to the ship and is paying for transport to the port. Unlike FOB, the seller doesn’t have to purchase insurance to cover against loss.

Cost, Insurance and Freight (CIF)

CIF is the next phase of maritime responsibility terms that requires the seller to transport, arrange, pay for and obtain insurance coverage until loading onto a vessel.

Get Expert Guidance in Using the ICC Incoterm That Is Right for Every Load With FreightMango

Rather than risking liability or delays in international trade, ensure your team is equipped to succeed by knowing how to apply the ICC Incoterm rules that are right for your needs. Part of that ability rests with choosing the right expert to help manage and execute your international transports. Connect with FreightMango to get started today.

Get instant quote

and compare offers in real time

Get instant quote

and compare offers in real time